· BAS due date August 21 September; BAS due date September 21 October; BAS due date October 21 November. BAS due date November 21 A penalty may apply if you fail to lodge on time, so – even if you need extra support to pay – lodge on time or contact us to discuss support options. If you are finding it hard to pay by the due The due date for the monthly BAS/IAS is the 21 st day of the month following the end of the taxable period. There is no extension if you lodge online or through a Tax/BAS agent.

Due dates for BAS & IAS lodgement - Accounting Mate

To ensure your clients receive the lodgment program due dates, you should lodge activity statements December monthly, and all quarterly activity statements using either of the following channels:. The lodgment program due dates for quarterly activity statements and December monthly will now show on your client lists. This is where your client has elected to receive and lodge the activity statement electronically and the activity statement meets the eligibility criteria.

The electronic lodgment and payment concession does not apply to standard monthly activity statements. The scope of services that registered BAS agents can provide to their clients was expanded in response to COVID You can find more information at BAS Services External Link on the Tax Practitioners Board website.

If you or your clients can't lodge by the lodgment program dates because of exceptional or unforeseen circumstances beyond your or your clients' control, you can request a deferral. Show download pdf controls. Show print controls. BAS agent lodgment program —23 Find out BAS agent lodgment and payment due dates, and what to do if you can't lodge on time. On this page About the BAS agent lodgment program Lodgment and payment due dates Other lodgment obligations If you can't lodge on time About the BAS agent lodgment program The BAS agent lodgment program —23 includes: lodgment and payment concessions when you have elected on behalf of your client to receive and lodge eligible quarterly activity statements online a lodgment concession for pay as you go PAYG withholding payment summary annual reports lodgment and payment concessions where your client is an active STP reporter and has elected to receive and lodge a paper activity statement.

To ensure your clients receive the lodgment program due dates, you should lodge activity statements December monthly, and all quarterly activity statements using either of the following channels: Online services for agents Practitioner lodgment service PLS.

Lodgment and payment due dates The lodgment program due dates for quarterly activity statements and December monthly will now show on your client lists.

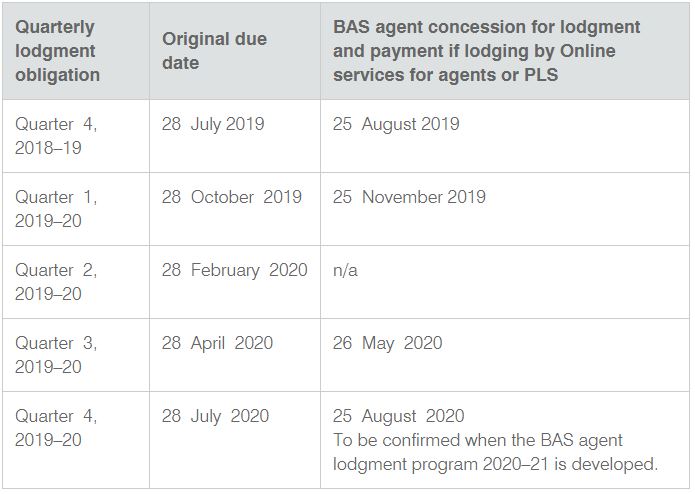

Table 1: BAS agent due dates — monthly lodgment obligation Monthly lodgment obligation Due date BAS agent concession for lodgment and payment if lodging by Online services for agents or PLS Activity statement 21st of the following month Not applicable The electronic lodgment and payment concession does not apply to standard monthly activity statements. Table 2: BAS agent due dates — quarterly lodgment obligation Quarterly lodgment obligation Original due date BAS agent concession for lodgment and payment if lodging by Online services for agents or PLS Quarter 4, —22 28 July extended due date for bas lodged online August Quarter 1, —23 28 October 25 November Quarter 2, —23 28 February Not applicable Quarter 3, —23 28 April 26 May Quarter 4, extended due date for bas lodged online, —23 28 July 25 August To be confirmed when the BAS agent lodgment program —24 is developed, extended due date for bas lodged online.

Other lodgment obligations Registered BAS agents can also lodge: PAYG withholding payment summary annual report super guarantee extended due date for bas lodged online SGC statement — quarterly form taxable payments annual report income statements or payment summaries, employee termination payments, gross wages, allowances, PAYG withholding and other taxable and non-taxable payroll items Single Touch Payroll reports a tax file number declaration on behalf of a client an application to the Registrar for an Australian business number External Link on behalf of a client.

If you can't lodge on time If you or your clients can't lodge by the lodgment program dates because of exceptional or unforeseen circumstances beyond your or your clients' control, you can request a deferral. If you request a deferral, you must provide supporting reasons. Last modified: 01 Jul QC Not applicable The electronic lodgment and payment concession does not apply to standard monthly activity statements.

How to Upload Your GST to ATO Using myGov Account

, time: 6:54DUE DATES – ATO BAS

the due date is 15 May for tax returns, as you already have an extension of time to lodge and pay to 5 June (a concessional due date in the lodgment program). you are affected by a · BAS due date August 21 September; BAS due date September 21 October; BAS due date October 21 November. BAS due date November 21 The due date for the monthly BAS/IAS is the 21 st day of the month following the end of the taxable period. There is no extension if you lodge online or through a Tax/BAS agent.

No comments:

Post a Comment